The Ultimate Buying Guide to Purchasing a Property in Austria

How to buy a property in Austria? What is the purchase process if you want to acquire a chalet or a ski apartment in Austria?

Well done - you have made the bold decision to invest your well-earned money in a property in Austria. Austria is a charming place with traditional mountain villages, imposing snow-capped summits and friendly welcoming people. It is also a country that compared to many of its alpine neighbours offers some great value-for-money properties for sale with attractive rental income market. So whether your purchase is an emotional buy or a sound investment decision, Austria is a great place to buy a second home. But even though Austria has a strong legal framework and property buying process is generally quick and straightforward, there are many regional variations to the process which buyers may find confusing.

In Domus Global, we have a long track record of helping buyers purchasing all kind of property, from investment ski apartments to holiday chalets and hotels. We will assist you step-by-step throughout the process, providing our specialist knowledge and advice, to ensure you are always well-informed and get the best deal. We want happy buyers!

This buying guide will help you in getting your head around the different stages of the property buying process. For anything you don't find here, please contact us!

x

Austrian property search and selection process

1. Selecting the optimal resort for you

2. Investment property vs. holiday home explained

3. "Tourist Residence" explained

4. Other property aspects to consider

Step-by-step guide through Austrian property purchase

5. Property purchase restrictions for foreigners

6. Austrian property purchase manual

7. Ancillary taxes and fees associated with purchase

8. Getting a mortgage to finance your property

Austrian Property Search and Selection Process

x

Some people have been visiting the same Austrian resort for years and know exactly where they want to buy. But then there are those who have not made their mind yet - so what should you consider if you are still undecided? Austria is divided into nine federal provinces, each characterised by a diverse landscape and regional specifics, from different language dialects to culinary delicacies, customs and local laws. Most ski areas are located in Salzburgerland and Styria on the east of the country, Tyrol and Vorarlberg in the west of the country and Carinthia in the south of the country.

Ski area - Skiing infrastructure is superb across the country, so it is more about whether you like a vast ski area with hundreds of kilometres of slopes or a smaller more private resort. Although only a handful are known outside the country, Austria actually has countless small to mid-size resorts with 40 to 100km of ski runs, so be open minded when you hear about new places - they may surprise you. Although some people are focused on glacier or high-altitude skiing, snow-making infrastructure has hugely developed over the last years and is sometimes better than in the French and Swiss Alps, so ski season tends to be relatively long even in lower-altitude resorts.

Property prices - Tyrol and Vorarlberg encompass some of the most famous ski hotspots including Kitzbühel, Lech, St. Anton am Arlberg or Sölden where you will find some incredibly stunning luxury properties with equally jaw-dropping price tags. On a general level, prices tend to be lower in the rest of the country. But there are always exceptions to the rule. In any case, whatever your budget is, you should be able to find a suitable solution.

Distance to airports - If you plan to fly in, then distance to airport is a crucial variable, especially if you intend to come for weekend getaways and short periods. Munich, Salzburg and Innsbruck are the key access points for most ski resorts, although Klagenfurt in Carinthia and Ljubljana in Slovenia are also close to resorts in southern Austria and have increasingly new connections to European cities. Don't forget to consider whether you rent a car or use public transportation to reach your holiday home. Austria has got excellent train network, so most major resorts are easily accessible.

Resort seasonality - Although it is mostly known for its winter offering, Austria has great appeal across seasons. Fresh air, mountain peaks and flowery meadows are the perfect backdrop for any type of activity from hiking, mountain biking to swimming in alpine lakes and playing golf. But this is not taken for granted and unlike many of its Swiss or French neighbours, Austrian resorts have gone to massive lengths to support year-round tourism. Nowadays, every resort offers a "summer card" with a list of varied activities for children and adults alike from theme parks to themed walks, indulging spas, tennis and golf courses, cooking courses and much more. In most resorts, key lifts remain open to whisk summer visitors to the mountain peaks and enjoy the dense network of trails high up in the mountains. So dual-seasonality is absolutely normal and entertainment is guaranteed throughout the seasons. In addition, most resorts are keeping up pace with the millennial demand and embrace all types of visitors - so expect yoga courses in open nature, vegan menus in restaurants and organic farm stays for families.

Viewing trip - If you have the time, the best way to get the right idea of what exactly you want is doing a short viewing trip. Domus Global will be happy to assist you in designing the best itinerary to allow you to visit several different properties, so that you have a better idea of the property market options, prices, etc. Bear in mind that in high season, in some properties viewings are only possible on Saturdays when rental guests change.

x

Each property in Austria has a defined legal status which determines the manner in which owners are allowed to use the property. Properties will typically fall in one of the following categories:

"Permanent Residence" - this type of property is intended for long-term stay and therefore optimal for those who want to permanently relocate to Austria. Owners need to register as permanent residents in the property and become Austrian tax residents. It is also possible to rent out this type of property on a long-term basis to someone who will register there as a permanent resident. Given these strict requirements, permanent residences are usually not suitable for most foreigners who only want to use the property occasionally as a holiday home.

"Tourist Residence" - A variation on the Anglo-Saxon "buy-to-let" property, this type of property presents an attractive combination of investment property and holiday home and is the most sought-after by foreign buyers. These properties allow several weeks of private use to their owners (typically 4 to 12) and are sublet to visitors by a professional agency in owner's absence. Thanks to the rental income, owners can achieve an attractive net rental yield, usually between 4-6% per annum. This concept is extremely well developed in Austria as regional authorities attempt to support the tourist sector and prevent the creation of "ghost towns" whereby foreigners would purchase a property and only use it a couple of weeks every year. The rental management is a hassle-free exercise for owners as the management agency will cover everything from guest management, check-ins and check-outs, cleaning and maintenance. There is also a significant tax advantage for acquiring a “Tourist Residence” in Austria.

"Second Home" (="Zweitwohnsitz") - this type of property offers complete flexibility of use. Owners do not need to register as permanent residents, they can use the property freely as they wish, sublet it on long- or short-time basis or not sublet it at all. Properties with this legal status are extremely rare, particularly in Tyrol and Salzburgerland. From 2018, the number of Second Homes in Salzburgerland has been restricted and municipalities with more than 16% of existing second homes are no longer allowed to permit new Second Home projects. If you are looking exclusively for a Second Home, Domus Global still has a good choice of these properties.

Deciding whether you want an investment type of property or a flexible second home is the one most important thing to decide about the property you want. Bear in mind that if you decide for the latter, your choice will be significantly more limited.

As explained further above, "Tourist Residence" is a type of property which allows for a combination of investment rental use and private use. But the way these properties work can vary from one property to another. So what are the most important aspects you should look at when buying an investment property of this type?

Rental management agency - In vast majority of new-build projects, there will be one single rental management company selected by the developer to manage all of the apartments in the project, so on purchase each apartment owner will need to sign the Operating Agreement with this agency. The agreement is usually signed for a term of 10-25 years. The responsibilities of the agency are broad and include marketing & booking management, on-site guest management, cleaning, maintenance and account reporting to owners. The agency typically charges a commission for this work of c. 20 - 30% of rental revenues.

Rental yield - Your property will earn you an attractive net rental yield every year. You will receive a regular detailed report from the agency about occupancy levels, costs and results. An average net rental yield is between 3% and 6%. Some projects offer a "guaranteed yield" - this is usually a more conservative figure, but provides you with a certainty of income. Some developments are managed on a so called "pool system" - this means that revenues from all apartments are aggregated and then distributed equally among owners following a distribution key usually based on original purchase price of each apartment. In this type of management, it does not matter whether and how much your actual apartment got rented out compared to others - each owner receives an equal proportional share of income.

Private use restrictions - The restrictions on private use vary from one property to another, but typically are 4 to 8 weeks per year plus last minute stays. Some properties can provide increased flexibility. Sometimes there can be restrictions for private use during specific periods of the year. In some properties, owners are requested to pay a discounted price for their stay - this is usually in projects with a pool system in order not to affect the overall yield of the project (so even though you pay for your stay, you will get it back with your rental income). You can usually book your stay in advance on an online platform managed by the agency.

VAT rebate - Many tourist residences are off-plan or new-build properties that can benefit from partial or total VAT rebate. Please see further information here.

Income tax on rental income - You will have to pay income tax in Austria every year on the rental income you receive from your property. But a large amount of the tax can be offset. There is a very advantageous write-off system for rented properties. If you bought your property with a mortgage, then the interest can be written off against rental income. There is also a personal tax allowance for individuals of c. EUR 2,000 per person which you can use. So if you bought your property jointly with your partner or friend, this allowance doubles. Considering the average net rental income, the amount of tax payable is very low.

Once you have decided whether you prefer an investment type of property with rental income or a second home with flexibility of use, there are other aspects to consider:

Facilities - Given the difficulty of parking in most resorts, ski apartments in Austria are usually sold with a parking space - this can either be an underground garage, a carport or an outside parking space. Most apartments also have a storage located outside of the apartment in the basement or elsewhere in the property - this is where you will be able to store your sport equipment or other personal items when your apartment is rented out. Other communal facilities can include anything from reception, restaurant, swimming pool, wellness, playground etc. - these facilities are an excellent addition to the property, but as owners jointly bear the running costs, bear in mind this may slightly affect your investment yield.

Furniture - Apartments in new developments earmarked for tourist rental are usually sold turn-key with all furniture, sometimes even with equipment and amenities such as cutlery or wifi. This is to ensure consistency of all apartment units for rental purposes. However, you will usually be able to select from a few furniture packages offered by the developer to suit your personal taste. The advantage of new-builds is that they use the latest technologies and efficient energy systems and focus on green solutions. Second Home properties are usually sold without furniture.

Step-by-step Guide Through Austrian Property Purchase Process

Since 2001, EU nationals can buy property in Austria with no restrictions. Citizens of other countries that belong to the EEA (European Economic Area) and Swiss citizens can also buy property in Austria, although additional paperwork is required.

Non-EU nationals cannot buy property in several provinces including Vorarlberg, Tyrol and Salzburgerland. In other provinces, non-EU nationals may have to purchase a foreigner's purchase permit or the property needs to be advertised for a specific period before it can be sold to a non-EU national, so the process is indeed complex. For non-EU nationals, a consultation with a lawyer is helpful to understand the specific requirements in each and every case.

You have viewed several properties and decided which one is the right for you - now comes the actual purchase process and paperwork. In Austria, the property purchase process tends to be straightforward and quick, especially in new-build projects.

- Your offer: The first step is usually to sign an Offer to Purchase for the property ("Kaufanbot"). This is a brief document that sets out the details of the property, the agreed price and payment schedule, as well as all ancillary taxes and fees related to the purchase. The property is then taken off the market.

There is no deposit payable on signing of this document, but it is nevertheless a binding agreement, so you should have all your finances prepared (make sure you have a valid mortgage offer in hand or funds ready to access in case you pay in cash). The Offer to Purchase is prepared by Domus Global in collaboration with the vendor.

- Documentation: Once the Offer is signed by both parties, the notary will start preparation of the Deed of Sale ("Kaufvertrag") and all ancillary documentation. This usually takes between 2 and 4 weeks. The Deed of Sale will typically include an extract from the Land Registry, all details of the property and the mechanism of the escrow account ("treunhandkonto").

The escrow account is a secure payment mechanism often used in property purchases which ensures that buyer's money is safely held in the lawyer´s/notary's account controlled by the relevant chamber and only reach the vendor once the property is fully transferred.

Other documentation will include KYC ("know-your-client) confirmations, PEP ("politically exposed person") form and other documents that may be required regionally. If you are purchasing a "Tourist Residence", you will also need to sign the "Operating Agreement" ("Betreibervertrag") with the professional management agency which will set out the terms and conditions of their services and the use of the property (incl. the agency's commission, duration of the contract, restrictions on private use, etc.). Usually, there is also the "Building Management Agreement" ("Verwaltungsvertrag") with the building manager / caretaker which outlines operational matters in the building (e.g. management of communal spaces, utilities, owners' meetings etc.) and in apartment buildings a contract that sets up the condominium (Wohnungseigentumvertrag). Domus Global will assist you in getting through the documents answering any queries. We will also arrange for translations in English or your language.

- Signing: Only the Deed of Sale requires a certified signature by the buyer. This means you can either come to Austria and sign at the notary's office or; at the Austrian Embassy / Consulate where officials have the required authority to certify your signature.

- Payment: After both parties have signed the Deed of Sale, the owner usually has about 2 weeks to transfer the funds (including fees and taxes) into the escrow account held with the lawyer/notary. For off-plan properties where there is a progressive payment schedule, escrow account is used as well and at each payment date you will be notified. The lawyer/notary will then proceed with the registration at the Land Registry - the timeline can vary between 2 weeks up to 3 months. There is just one original of the Deed of Sale which the Notary will send to the Buyer after the registration is completed.

- Property Handover: Buyers can usually arrange a formal handover of the property once payment is completed / once notified by the notary. This is an important moment to learn everything about the day-to-day functioning of the property, utilities, booking of private stay etc.

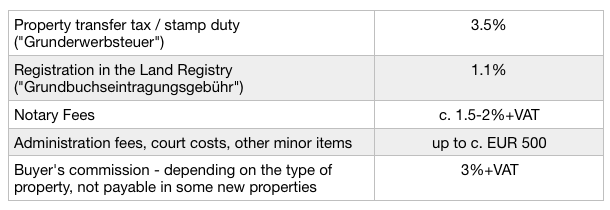

The fees and taxes related to property purchase in Austria are usually the same for all properties and are typically calculated off the property gross price (sometimes the notary fees are also added in the calculation basis).

It is possible to finance your Austrian property via a mortgage. Banks in your home country may or may not be able to provide a mortgage against a property located in Austria. Alternatively, you can take a mortgage from an Austrian bank against your new Austrian property. Sometimes, developers have a financing partner to assist buyers - this is usually a local bank that is familiar with the project and can offer attractive terms and speed of process.

Mortgage terms are typically up to 60% of gross property price (excluding ancillary purchase costs and fees) and up to 20 years principle and interest repayment. The bank will typically charge you a mortgage arranging fee and a property appraisal fee. You will also have to pay a fee of c. 1.2% for the registration of the mortgage in the Land Registry. As interest rates continue to be very low compared to historical standards, interest rates tend to be around 2-3% per annum.

Ideally, you should consult your bank about the mortgage prior to signing the Offer to Purchase, so that in case your mortgage offer falls through, you are not liable for notary's fees.

If you are planning to buy an off-plan or new-build property, there is a couple of points worth knowing.

First come, first serve - Developers are usually required by their financing bank to sell at least 50% of the units in their projects before they are allowed to start construction. This means that by the time construction is completed, the development could be sold out. So if you have a serious interest, do not wait with your purchase. First comers have the widest choice of apartments and sometimes developers can accommodate special wishes (apartment layout, extra features, etc.). Also, developers tend to increase prices once they see that the project gains interest and sales accelerate.

VAT - Brand new property usually attracts 20% VAT. However, if your property has a "Tourist Residence" status, then you can save all or a large part of this amount, depending on the annual length of your private use (i.e. you can claim tax rebate for all the periods when your apartment is offered for rent to visitors).

How is VAT payable? Typically, you will pay full VAT on purchase and then reclaim it back within 2-6 months following purchase. In some cases, developers have pre-arranged an easier solution for buyers, so sometimes buyers are only required to pay a small portion of VAT (e.g. 1-2%) or other times they do not pay VAT at all. Domus Global will put you in touch with a local tax advisor to assist you with the process.

Staged payments - Buying off-plan offers advantageous staged payment schemes. This means that you pay for your apartment in stages corresponding to construction milestones. Each instalment is made into the escrow account held with the notary, so your money is safe, and each instalment is only released to the developer once an independent surveyor has inspected the construction. Below is a typical staged payment schedule for an off-plan development:

- 15% at start of building works

- 35% on completion of the shell and roof

- 20% on completion of plumbing and electricity

- 12% on completion of the façade & windows

- 12% on full completion of the property

- 4% on formal handover

- 2% after 2-3 years

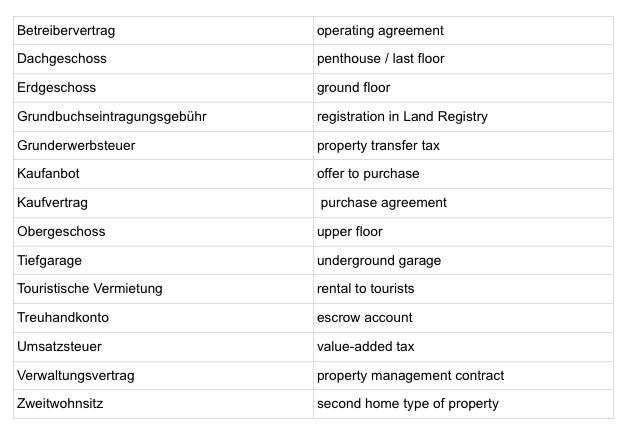

You will definitely come across some of the below words during the purchase process, so it may be handy do know what they mean.

Congratulations - you just became an owner of a property in Austria! You can now enjoy everything this beautiful country has to offer from fairytale landscapes, fabulous ski infrastructure and delicious culinary scene.